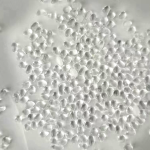

September 04, 2024 – Titanium dioxide producers in the international market have recently initiated a wave of price hikes. Titanium dioxide, a crucial inorganic chemical pigment, is characterized by its particle size as a key indicator of quality. The smaller the particle size, the better its covering power, dispersibility, and weather resistance. This material is indispensable in the industrial sector, and its market performance continuously underscores its central role in modern industrial and economic development.

In terms of market demand, the requirement for titanium dioxide far exceeds the global per capita level, and stable exports provide a solid foundation for the sustained growth of the titanium dioxide industry. In particular, downstream industries such as coatings and cosmetics maintain robust demand for titanium dioxide, indicating significant market potential for future demand.

According to the Color Masterbatch Industry Network, with technological advancements and industrial upgrades, the production techniques of titanium dioxide are continuously optimizing, and the economic benefits of its by-products are expected to further increase. For instance, the titanium dioxide industry can now enter the lithium iron phosphate industry chain through the by-product ferrous sulfate, presenting a new profit growth point for the sector.

Although the peak period of the titanium dioxide industry has passed, technological barriers have gradually lowered, and the industry threshold is no longer as high as before. However, when market supply exceeds demand, price correction becomes an inevitable trend. Nevertheless, in the long run, amidst the sustained tension in the supply and demand relationship of the titanium dioxide industry, this sector is expected to maintain high prosperity.

In the investment field, the following titanium dioxide-related enterprises have attracted significant attention:

Jinpu Titanium Industry: As a large domestic producer of sulfuric acid process titanium dioxide and an industry backbone, it has a price-to-book ratio of 1.50 and a total market value of 2.062 billion. Apart from the titanium dioxide concept, it also involves phosphorus chemical and lithium battery concepts.

Huiyun Titanium Industry: Focusing on the research, production, and marketing of titanium dioxide, with a price-to-book ratio of 2.37 and a total market value of 3.092 billion. It possesses both titanium dioxide and margin financing and securities lending concepts.

Kunchai Technology: As a leading global research, development, production, and sales enterprise of pearlescent materials, with a high price-to-book ratio of 11.58 and a total market value of 21.825 billion. It not only involves the titanium dioxide concept but is also a crucial participant in specialized and sophisticated technologies and the Fujian Free Trade Zone.

CNNC Titanium Dioxide: A renowned domestic producer of titanium dioxide, with a price-to-book ratio of 1.15 and a total market value of 13.471 billion. It covers multiple areas such as titanium dioxide, phosphorus chemicals, and power battery recycling.

Vanadium Titanium: As the largest domestic production base for vanadium and titanium and a leading global producer of vanadium products, its titanium dioxide output ranks among the top three in China. With a price-to-book ratio of 1.77 and a total market value of 21.75 billion, it integrates concepts such as small metals, vanadium batteries, and titanium dioxide.