September 25, 2024 – Domestic petrochemical inventories have witnessed a surge, with the total polyolefin stockpile of the two major oil companies amounting to 810,000 tons, marking an increase of 35,000 tons compared to the previous week.

In the realm of Shenhua auctions, today’s linear auction volume stood at 950 tons, with actual transactions reaching 831 tons, indicating a certain level of market activity. However, both high-pressure and low-pressure products were absent from today’s auctions, resulting in zero transaction volumes for these categories.

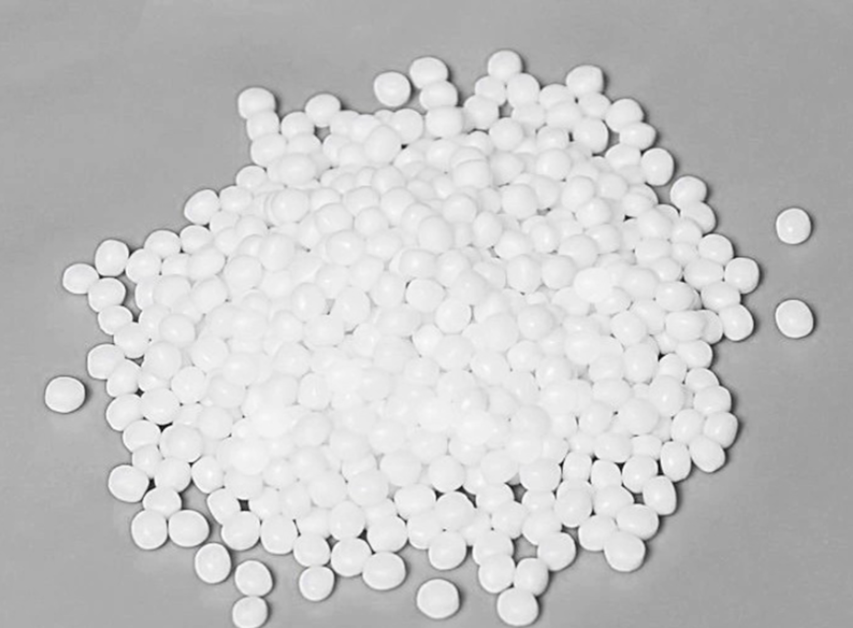

According to insights from the Color Masterbatch Industry Network, the domestic PE market exhibited a slight divergence today. The low-end prices in the high-pressure market in North China rose by 100 yuan/ton, while prices in other regions remained relatively stable or experienced minor declines. The further implementation of the Federal Reserve’s interest rate cut policy led to a minor uptick in international oil prices, bringing some positive news to the market. In some regions, the supply of high-pressure market goods was tight, prompting traders to adopt a price-hiking strategy for shipments. Despite terminal demand continuing its slow growth, overall market transactions were still considered satisfactory.

Looking ahead, in terms of PE market supply, only the Yangzi Petrochemical HDPE plant is scheduled for maintenance in the short term, with a capacity of around 70,000 tons, while the Guangdong Petrochemical HDPE plant plans to restart, with a capacity of approximately 400,000 tons. Therefore, the supply of HDPE goods may increase slightly, while the supply of other goods remains relatively stable. On the demand side, as the National Day holiday approaches, downstream factories may initiate early stockpiling, thereby boosting their procurement enthusiasm for raw material PE. Taken together, the polyethylene market is anticipated to consolidate within a range in the short term.

Furthermore, mainstream price quotes in the PE market showed diverse trends across various product categories. Meanwhile, the PE futures market also exhibited some volatility, with the L2501 contract price experiencing a decline. According to calculations by Tuoduo Data, on September 23, the domestic HDPE spot price index fell by 12 points, the LDPE film spot price index rose by 5 points, and the LLDPE spot price index dipped by 1 point.