February 19, 2025 – PVC Powder Market Faces Chilly Winds as Profitability Plummets

The PVC powder market has been caught in a cold spell in recent years, with persistent weak demand and a growing glut leading to a relentless slide in prices. This dire situation has severely impacted the profitability of the industry, with most PVC powder enterprises mired in losses since 2023. The crisis has also rippled through to the profit margins of its key raw material, calcium carbide.

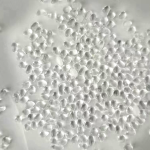

PVC powder, a downstream product of vinyl chloride, is primarily produced through two methods: the carbide method and the ethylene method. Given China’s coal-rich and oil-poor energy structure, the carbide method accounts for a dominant 73.39% of PVC powder production capacity. As one of the five major general-purpose plastics, PVC powder finds widespread application in everything from rigid products like pipes and profiles to flexible items such as films and wires and cables.

However, the profitability landscape of the PVC powder industry has undergone a dramatic transformation. Over the past few years, a confluence of unexpected events, policy shifts, and changes in end-user demand has significantly altered the profit distribution along the PVC powder supply chain. Particularly since 2022, the deep adjustment in the real estate sector has led to a sharp decline in orders for PVC powder end-products, with weak demand trickling back up the supply chain and causing a steep fall in the prices of both PVC powder and calcium carbide, resulting in a precipitous drop in profitability.

According to AsiaMB’s sources, the PVC powder supply chain was in a virtuous cycle in 2020, with profitability extending from the bottom up. But this positive trend was short-lived. The introduction of the “dual carbon” policy in 2021 led to notable production cuts in calcium carbide, significantly boosting the profitability of the carbide industry while tightening the supply of PVC powder. Downstream manufacturers saw their profitability decline due to the surge in raw material costs. By 2022, the overall profitability of the PVC powder supply chain had markedly deteriorated, with the carbide method of PVC powder production slipping into losses in the second half of the year. Conversely, end-product manufacturers experienced an improvement in gross margins as PVC powder prices fell.

Today, the operational pressures on the PVC powder supply chain remain immense. Although downstream manufacturers have benefited from lower costs due to the decline in PVC powder prices and maintained some profitability, weak demand growth has meant that the supply of PVC powder continues to outpace demand, keeping the industry under pressure. Both PVC powder and calcium carbide enterprises are deeply entrenched in losses and urgently need to adjust and optimize their operations.

Looking ahead, demand for PVC powder end-products from the real estate sector is unlikely to see significant growth, and industries related to real estate will continue to face inadequate demand. Downstream manufacturers will undergo further consolidation, potentially leading to a reduction in the number of small and medium-sized enterprises. End-user manufacturers will focus more on controlling raw material procurement costs and enhancing their bargaining power over raw materials.

Against this backdrop, the PVC powder and calcium carbide industries will accelerate their adjustment and optimization efforts to adapt to changing market demands and improve overall efficiency. The future development of the PVC powder supply chain will be fraught with challenges but will also harbor new opportunities.