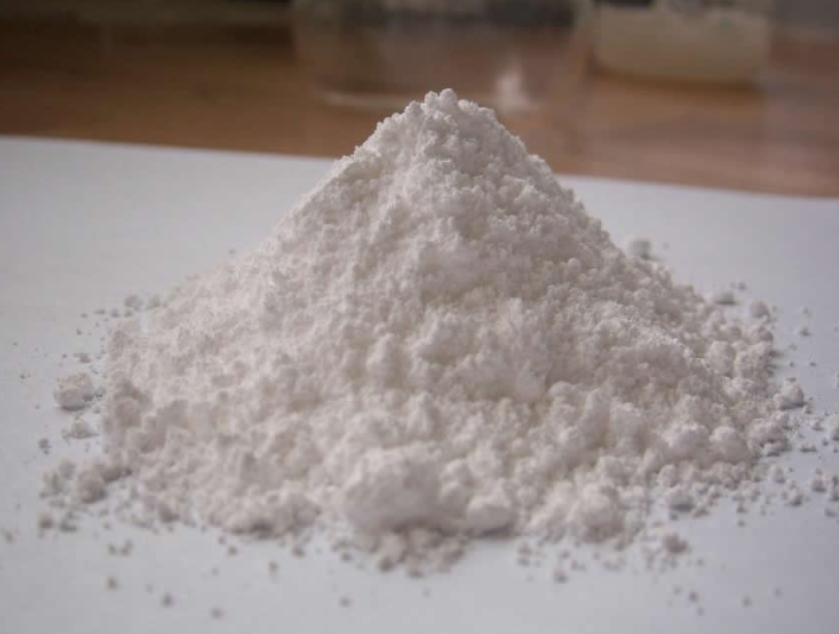

November 04, 2024 – The titanium dioxide (TiO2) industry in 2024 has witnessed a stark divergence in fortunes among its players. Amidst the dual pressures of a slowing macroeconomic growth and a persistent downturn in the real estate sector, the domestic TiO2 market has faced increasingly prominent supply-demand imbalances. Furthermore, anti-dumping measures imposed by the European Union have posed significant challenges to the export business of some TiO2 companies. Nevertheless, amidst this prevalent gloom, certain enterprises, such as Longbai Group and Zhonghe Titanium, have stood out with their impressive performance.

According to Color Masterbatch Industry Network, Longbai Group achieved revenue of RMB 20.866 billion in the first three quarters of this year, representing a year-on-year increase of 2.98%. Its net profit attributable to shareholders soared by 19.68% to RMB 2.564 billion. This remarkable achievement is attributed to the company’s continuous optimization of its product mix and relentless efforts in market expansion. In contrast, companies like Vanadium-Titanium Industries, Jinpu Titanium, Annada, and Anning have experienced varying degrees of decline in their performance. Notably, Vanadium-Titanium Industries’ revenue for the first three quarters fell by 6.12% year-on-year, with its net profit attributable to shareholders dropping sharply by 78.92%.

Zhonghe Titanium is another notable performer. The company realized revenue of RMB 5.149 billion in the first three quarters, marking a 43.26% year-on-year increase. Its net profit reached RMB 448 million, up by 33.98% compared to the same period last year. This growth is primarily fueled by an increase in TiO2 sales volume and an uptick in sales prices.

However, the overall price trend of TiO2 in China this year has exhibited a pattern of fluctuating upwards before declining. Although the average market price in the first three quarters was slightly higher than that of the previous year, the downstream coatings industry has suffered from insufficient production due to the real estate downturn, resulting in weak market demand for TiO2. In this context, the export market has become a crucial support for TiO2 enterprises. Unfortunately, following the EU’s imposition of tariffs on domestic TiO2 producers, export prices have risen, and export volumes have also been affected.

In response to these challenges, Chinese TiO2 enterprises have not remained passive. While actively addressing the EU’s anti-dumping measures, they are also exploring markets in countries along the “Belt and Road” and other cooperative nations to seek new growth opportunities. Despite the current pressure from export orders, Chinese TiO2 enterprises are striving to find breakthroughs to achieve more stable development in the future.