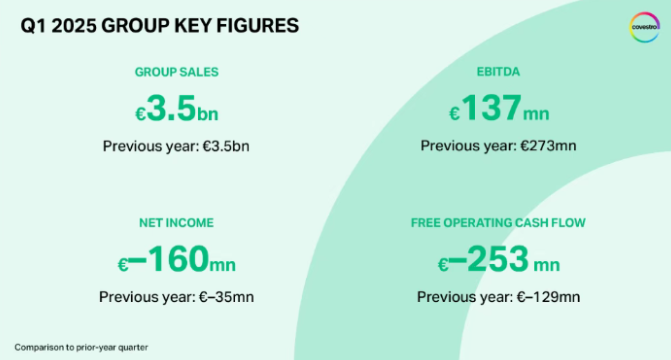

May 7, 2025 – On May 6, Covestro officially released its first – quarter report for the 2025 fiscal year. Against the backdrop of a complex and volatile global economic situation, its performance and future strategic layout have drawn significant attention from the industry. Reported data shows that Covestro’s sales in the first quarter remained basically flat compared to last year, reaching €3.48 billion (approximately RMB 28.5 billion), with a slight year – on – year decrease of 0.9%. The EBITDA was €237 million, nearly halved year – on – year. Among these, the one – time impact of the planned closure of the PO11 plant in Maasvlakte, the Netherlands, was a key factor contributing to the decline in performance. However, the €137 – million result still reached the upper limit of the initial guidance, slightly higher than the market – expected €125 million. The net income in the first quarter was – €160 million, an expansion of losses compared to – €35 million in the same period last year. The free operating cash flow (FOCF) was – €253 million, also down from – €129 million in the same period last year.

Affected by the turbulent regional situation and trade tensions triggered by US tariff policies, geopolitical uncertainties have intensified. The global economic growth forecast for 2025 has been downgraded from 2.8% to 2.6%. Facing this challenging market environment, Covestro has accordingly adjusted its performance expectations for the 2025 fiscal year. The EBITDA expectation range has been narrowed from €1 – 1.6 billion to €1 – 1.4 billion, and the ratio expectation of return on capital employed (ROCE) to weighted average cost of capital (WACC) has also been reduced.

As AsiaMB has learned, under the pressure of performance, Covestro has been continuously promoting its strategic transformation. In the first quarter of 2025, Covestro, in collaboration with LyondellBasell, decided to permanently close the joint – venture propylene oxide/styrene monomer plant (PO11) in the Netherlands. This decision stems from global overcapacity, high energy and production costs in Europe, and the strong impact of Asian imports. However, Covestro’s commitment to the European market remains unshaken. This shutdown is an important part of its STRONG transformation plan, aiming to systematically improve efficiency and competitiveness. At the same time, Covestro is firmly moving towards circular and climate – neutral production. In March this year, it further clarified its 2030 goals: to reduce energy consumption per ton of products by 20% based on 2020, with an estimated reduction of 550,000 tons of carbon dioxide emissions. Its largest TDI plant in Dormagen, Europe, has completed a comprehensive modernization, and the new reactor system can reduce approximately 22,000 tons of carbon dioxide emissions annually. In addition, on April 30, Covestro reached an 8 – year long – term liquefied natural gas supply agreement with Ineos, which will take effect in 2027, providing a stable and reliable natural gas raw material and energy guarantee for its European operations and facilitating subsequent production operations and strategic transformation.