June 19, 2025 –

Global Ethane Trade Sees Strategic Shift as India Emerges Key Destination

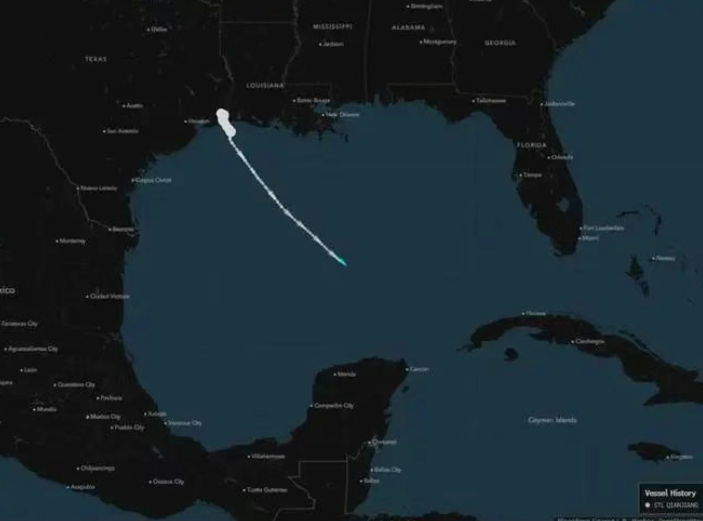

The maritime tracking system shows an unusual trajectory for the VLEC “STL Qianjiang” as it makes its way toward India’s Dahej port, signaling a strategic pivot in global petrochemical supply chains. The 87,000 cubic meter vessel, operated by Singapore-based Eastern Pacific Shipping, recently departed Nederland, Texas with a full ethane cargo destined for Reliance Industries’ newly commissioned import terminal.

Built in 2022, this state-of-the-art gas carrier previously served China’s booming ethylene production sector. Its current voyage represents the first confirmed instance of US-sourced ethane being redirected to South Asia through Chinese intermediary channels. Industry analysts note this development coincides with India’s aggressive expansion in polymer production capacity.

Reliance Industries has invested $450 million to develop specialized infrastructure at Dahej, including twin cryogenic storage tanks with 160,000-ton capacity and a dedicated pipeline network. The facility’s operational commencement in Q1 2025 has positioned India as a viable alternative market for North American ethane exporters facing trade barriers in traditional Asian markets.

Market intelligence suggests this transaction involves a creative contractual arrangement between Chinese producer Satellite Chemical and Reliance. Through a back-to-back agreement, the Indian conglomerate effectively assumes delivery rights for ethane originally contracted to Chinese buyers. Such innovative trade mechanisms are gaining traction as companies navigate evolving customs regulations and tariff structures.

“The Dahej-bound shipment demonstrates how market players are adapting to the new trade paradigm,” commented a Singapore-based petrochemicals analyst. “With India’s polymer demand growing at 8% annually and US ethane production hitting record levels, we’re witnessing the emergence of complementary trade flows that bypass traditional routes.”

The development comes as India’s masterbatch manufacturers report 12% year-on-year growth, driven by expanding domestic plastics processing capacity. Industry observers suggest the availability of competitively priced ethane-derived feedstocks could further boost India’s position in specialty polymer additives, including color masterbatch production.