May 6, 2025 – A seismic shift in the corporate landscape of the tire industry occurred on April 28 when Pirelli & C. Spa, the globally – recognized Italian tire manufacturing giant, released its 2024 financial report. Among the disclosed information, one revelation stood out prominently: the board of Pirelli officially confirmed the termination of ChemChina’s control over the company.

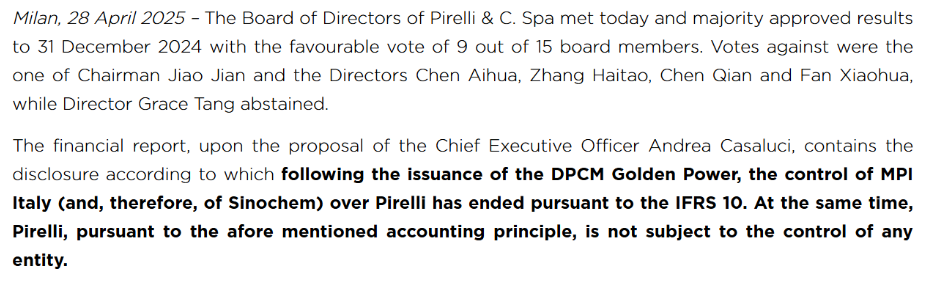

As per the proposal put forward by Andrea Casaluci, Pirelli’s CEO, the financial report detailed that following the implementation of the “Golden Power” act, based on International Financial Reporting Standard 10 (IFRS 10), the control exerted by MPI Italy, and by extension ChemChina, over Pirelli has come to an end. Moreover, adhering to the said accounting principles, Pirelli now operates without control from any entity. After the “Golden Power” act was promulgated, the statutory auditors and the management committee were the first to question ChemChina’s control over Pirelli via Marco Polo International Italy Srl (MPI Italy). With the support of auditing firms and leading law offices, an extensive and in – depth investigation was carried out. This decision aligns with the regulations of Consob, the Italian Stock Exchange Commission, which provided its assessment to the board, evaluating the situation in accordance with IFRS 10. However, some board members who voted against or abstained from the decision merely disagreed with the declaration of ChemChina’s control termination based on IFRS 10. They argued that since the shareholder agreement between Camfin and China National Chemical Rubber Co., Ltd. (CNRC), a subsidiary of ChemChina, and MPI Italy remains valid, CNRC/MPI Italy still retains control over Pirelli according to Article 93 of the “Uniform Financial Code” (TUF).

According to AsiaMB, the management emphasized that the decision regarding ChemChina’s withdrawal from controlling Pirelli is merely the initial step in the company’s corporate governance adjustment process, rather than a decisive one. This move is primarily aimed at complying with the regulatory restrictions in the United States. The US holds a pivotal position in the high – value tire sector, as well as in the development and distribution of Cyber Tyre technology. Consequently, the management reiterated its commitment to continuous dialogue with major shareholders, ensuring that Pirelli’s governance model complies with US regulations, especially in the realm of connected vehicles, thus safeguarding the interests of the company and all its stakeholders.

Historically, there have been persistent disagreements between Pirelli’s Chinese and Italian shareholders regarding the group’s governance. The root cause of these conflicts stemmed from Pirelli’s concerns that ChemChina, as a major shareholder, might impede its plans to enter the US market. In November last year, the Italian government initiated an administrative lawsuit against China National Chemical Rubber Co., Ltd. (CNRC), accusing it of potential violations of regulations designed to protect national strategic assets. As far back as June 18, 2023, Pirelli had disclosed that the Italian government had stripped ChemChina, its largest shareholder, of the authority to appoint the company’s CEO. With Pirelli’s recent announcement of the end of ChemChina’s control, the company’s future strategic planning and business expansion in the global market, especially in the US, will surely attract significant attention from the industry. How Pirelli navigates through the complex international market environment and regulatory policies to forge a new development path remains to be closely watched.