April 22, 2025 – As a global metropolis, Hong Kong grapples with significant challenges in solid waste management. With a land area of just 1,113.76 square kilometers and a population of approximately 7.5342 million by the end of 2024, the region boasts a staggering population density of 6,765 people per square kilometer. In 2025, Hong Kong generates around 15,000 tons of domestic waste daily, with 80% sent to landfills. Plastic packaging accounts for 23% of this waste stream, yet the recycling rate stands at a mere 30%. To tackle this pressing issue, on February 24, 2025, the Hong Kong Environmental Protection Department submitted to the Legislative Council a revised draft of the Product Eco-responsibility Ordinance and subsidiary regulations for the Producer Responsibility Scheme on Plastic Beverage Containers and Paper Beverage Cartons. Guided by the principles of “polluter pays” and “environmental responsibility,” the initiatives aim to boost resource recycling and mitigate waste’s environmental impact.

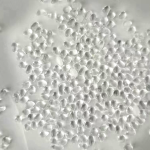

Hong Kong’s Producer Responsibility Scheme (PRS) is comprehensive and highly targeted. Operating under a “market-led model,” it mandates beverage suppliers to handle the recycling of plastic beverage containers and paper beverage cartons with a capacity ranging from 100 milliliters to 2 liters, either independently or through appointed “scheme operators,” leveraging market dynamics to enhance recycling efficiency. Regarding the registration system, except for exemptions, beverage suppliers must register as “registered beverage suppliers” with the Environmental Protection Department before distributing regulated beverage products in Hong Kong and submit semi-annual reports on product distribution volumes for effective government oversight. In terms of recycling infrastructure, self-recycling suppliers, operators, and large retailers must establish designated return points, with the government initially proposing a minimum rebate of HK$0.1 per container and carton. The government also aids in setting up additional points at suitable locations to refine the network. The recycling goals are phased over four stages, aiming for an initial 30% recycling rate for plastic beverage containers and 10% for paper beverage cartons, ultimately increasing to 75% and 50% respectively in the final stage, projected to be achieved within six to eight years. According to AsiaMB, this scheme constructs a robust recycling framework from multiple perspectives.

The Hong Kong government plays a pivotal role in implementing the PRS. As early as 2018, the Environmental Protection Department commissioned professional agencies to study solid waste disposal, drawing on international experiences to propose the producer responsibility plan. In 2021, it extensively solicited public opinions, receiving over 4,600 responses, and finalized the “market-led model” while including paper beverage cartons in the scheme. For supporting infrastructure, the government has invested in multiple recycling processing enterprises at the backend and piloted cross-border recycling channels with Shenzhen. At the frontend, it has deployed smart recycling machines, established community recycling stations, and partnered with supermarkets to set up collection points, creating a three-dimensional recycling network. Moreover, legislative amendments provide a solid legal foundation for the scheme’s implementation.

Hong Kong’s practices in solid waste management offer valuable lessons for mainland China. In terms of clarifying responsibilities, Hong Kong uses legislation to define hierarchical obligations for various parties and establishes market-based incentives. For phased implementation, it adopts a “pilot first” approach to gradually expand coverage. In refining key mechanisms, it formulates detailed rules for different materials and optimizes the coordination of interests along the recycling chain. These experiences present new ideas for mainland China to further enhance its extended producer responsibility system and promote resource circularity.