March 28, 2025 – The global automotive industry is racing towards a new phase of sustainability, with the environmental transformation of plastic materials emerging as a central topic. The extensive use of traditional fossil-based plastics in automobile manufacturing has triggered a series of challenges, including high carbon emissions, over-reliance on resources, and recycling difficulties. IDTechEx’s newly released report, “Automotive Sustainable Plastics Market Outlook 2025-2035: Players and Trends Forecast,” highlights that recycled plastics and bioplastics will be the two main forces driving the development of automotive plastics in the next decade, albeit with distinct trajectories and market potentials.

As a major consumer of plastics, the automotive sector consumes over 14 million tons annually, mostly derived from fossil fuels. This production method not only leaves a significant carbon footprint but also makes the industry highly sensitive to fluctuations in the oil market. Regions like the EU have introduced policies mandating that vehicles must contain 25% recycled plastic starting from 2025, while carbon tax pressures are also mounting, compelling automakers to accelerate their transition to sustainable materials. However, the path to widespread adoption of sustainable plastics is fraught with obstacles, including material performance and cost issues, as well as differences in application scenarios. For instance, recycling single-material components like polypropylene interiors is relatively straightforward, but the technology for recycling mixed-material parts is still immature.

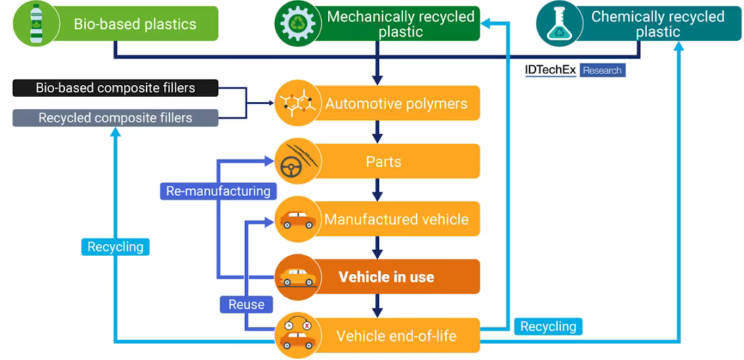

According to insights from the Color Masterbatch Industry Network, mechanical recycling technology is currently the most mature in the field of sustainable plastics. Through processes such as shredding, melting, and reprocessing, mechanical recycling enables the circular use of plastics without altering their chemical structure. Driven by EU regulations and supported by existing recycling systems, the application of mechanically recycled plastics in the automotive sector is expanding rapidly, with some automakers already incorporating recycled polypropylene into components such as seats and dashboards. Although chemical recycling technology can restore the performance of plastic materials, it is still in its early stages, costly, and limited in scale. The report forecasts that the use of recycled plastics in automobiles will grow at a compound annual growth rate (CAGR) of 29.1% from 2025 to 2035, reaching 2.567 million tons by 2035, making it the mainstream choice for short-term sustainability in the automotive industry.

Bioplastics, as another type of sustainable plastic, are made from renewable biomass and theoretically can effectively reduce dependence on fossil resources. However, their development is currently constrained by numerous factors. Supply chain bottlenecks are a primary concern, with limited production of bio-based polymers and potential land competition due to reliance on agricultural resources. In terms of cost, bioplastics are 30%-50% more expensive to produce than traditional plastics, limiting their application to high-end interiors such as bio-based leather. The report projects that the global use of bioplastics in automobiles will grow at a CAGR of 25.1%, but by 2035, they will only account for 18% of total automotive plastics, with a usage of 513,000 tons, still falling short of automakers’ sustainability targets.

To address the challenges in the development of sustainable plastics, the industry needs to tackle issues such as technological innovation, policy coordination, and supply chain collaboration. In terms of technological innovation, there is a need to develop recycling technologies suitable for complex components, enhance the durability of bioplastics, and reduce costs. Regarding policy coordination, global regulatory consistency needs to be strengthened, and investments in circular economy infrastructure, such as chemical recycling plants, should be increased. Supply chain collaboration is also crucial, with automakers needing to work closely with material suppliers and recycling companies to optimize the full lifecycle management from production to end-of-life.

Looking ahead, IDTechEx predicts that sustainable plastics will only account for 18% of total automotive plastics by 2035, highlighting the urgent task of sustainable transformation in the automotive industry. In the short term, recycled plastics will dominate the market with policy support and mature technology. In the long run, if bioplastics can overcome technological and cost barriers, they have the potential to complement recycled materials. Additionally, sustainable composites, tire innovations such as bio-based elastomers and self-healing materials, and circular economy models like single-material design will also become important directions for sustainable development in the automotive industry. Recycled plastics are currently a “must-have” for the automotive industry to achieve sustainability goals, while bioplastics are a “promising stock” for long-term low-carbon visions. Automakers need to adopt a multi-pronged approach encompassing policy compliance, technological innovation, and supply chain integration, while actively exploring diversified solutions such as recyclable composites and bio-based alternatives, to achieve a deeper sustainable transformation in the 2030s. Let us jointly anticipate greater breakthroughs by the automotive industry on the path of sustainability, contributing to a greener future for the planet.