March 25, 2025 – The Ministry of Commerce (MOFCOM) announced on March 22 that, following a review investigation, it has determined that the dumping of imported resorcinol originating from Japan is likely to continue or recur if the anti-dumping measures are terminated, and that such dumping would likely cause continued or recurrent injury to China’s resorcinol industry. Based on the investigation results, MOFCOM has recommended to the State Council Tariff Commission to continue the implementation of anti-dumping measures. Subsequently, the State Council Tariff Commission has decided that, effective from March 23, 2025, anti-dumping duties will continue to be imposed on imported resorcinol originating from Japan for a period of five years.

The anti-dumping measures on resorcinol imports from Japan and the United States were first imposed on March 23, 2013, through MOFCOM Announcement No. 13 of 2013, with a duration of five years. The duty rates were set at 40.5% for Japanese companies and 30.1% for U.S. companies. In 2019, through MOFCOM Announcement No. 10, these measures were extended for another five-year period. In 2024, upon the application of China’s resorcinol industry, MOFCOM initiated a sunset review investigation into the anti-dumping measures applicable to resorcinol imports from Japan, as announced in MOFCOM Announcement No. 9 of 2024. Since the United States has ceased production of resorcinol, no application for a sunset review was filed regarding imports from the U.S., and the anti-dumping measures on U.S. imports were terminated as of March 23, 2024.

MOFCOM conducted an investigation into the likelihood of continued or recurrent dumping of resorcinol from Japan and the potential for continued or recurrent injury to China’s resorcinol industry if the anti-dumping measures were lifted. The review determination was made in accordance with Article 48 of the Anti-Dumping Regulations of the People’s Republic of China (hereinafter referred to as the “Anti-Dumping Regulations”). The key findings are as follows:

- Review Determination: MOFCOM has determined that the dumping of resorcinol from Japan is likely to continue or recur if the anti-dumping measures are terminated, and that such dumping would likely cause continued or recurrent injury to China’s resorcinol industry.

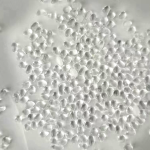

- Anti-Dumping Measures: In accordance with Article 50 of the Anti-Dumping Regulations, MOFCOM has recommended to the State Council Tariff Commission to continue the anti-dumping measures. The State Council Tariff Commission has decided that, effective from March 23, 2025, anti-dumping duties will continue to be imposed on imported resorcinol from Japan for a period of five years. The scope of products subject to the anti-dumping duties remains consistent with that specified in MOFCOM Announcement No. 13 of 2013. The product details are as follows: Chinese Name: Resorcinol, also known as 1,3-Benzenediol or Resorcin. English Name: M-dihydroxybenzene or Resorcinol. Molecular Formula: C6H6O2. Physical and Chemical Properties: Typically appears as white needle-like crystals, which gradually turn red when exposed to air. It is soluble in water, ethanol, and ether, and also soluble in chloroform and carbon tetrachloride, but insoluble in benzene. Primary Uses: Resorcinol is an important chemical synthesis intermediate and fine chemical raw material, mainly used in the production of rubber adhesives and ultraviolet absorbers. Additionally, it is used in the production of wood adhesives, flame retardants, and various pharmaceutical and pesticide intermediates. The product is classified under the Customs Tariff of the People’s Republic of China: 29072100. Resorcinol salts under this tariff code are not included in the scope of the products under investigation. The anti-dumping duty rates for Japanese companies, as stipulated in MOFCOM Announcement No. 13 of 2013 and No. 10 of 2019, are as follows: 1. Sumitomo Chemical Company, Limited: 40.5%; 2. Mitsui Chemicals, Inc.: 40.5%; 3. Other Japanese companies: 40.5%.

- Method of Imposing Anti-Dumping Duties: Effective from March 23, 2025, importers of resorcinol originating from Japan shall pay the corresponding anti-dumping duties to the Customs of the People’s Republic of China. The anti-dumping duties are calculated ad valorem based on the taxable value of the imported goods as determined by the Customs. The formula for calculating the anti-dumping duty amount is: Anti-dumping Duty Amount = Taxable Value of Imported Goods as Determined by Customs × Anti-Dumping Duty Rate. The value-added tax on imports is calculated ad valorem based on the taxable value of the imported goods, which includes the customs duty and the anti-dumping duty.

- Administrative Reconsideration and Litigation: In accordance with Article 53 of the Anti-Dumping Regulations, parties who are dissatisfied with this review decision may apply for administrative reconsideration or file a lawsuit with the people’s court in accordance with the law.

- Implementation: This announcement shall come into effect on March 23, 2025.